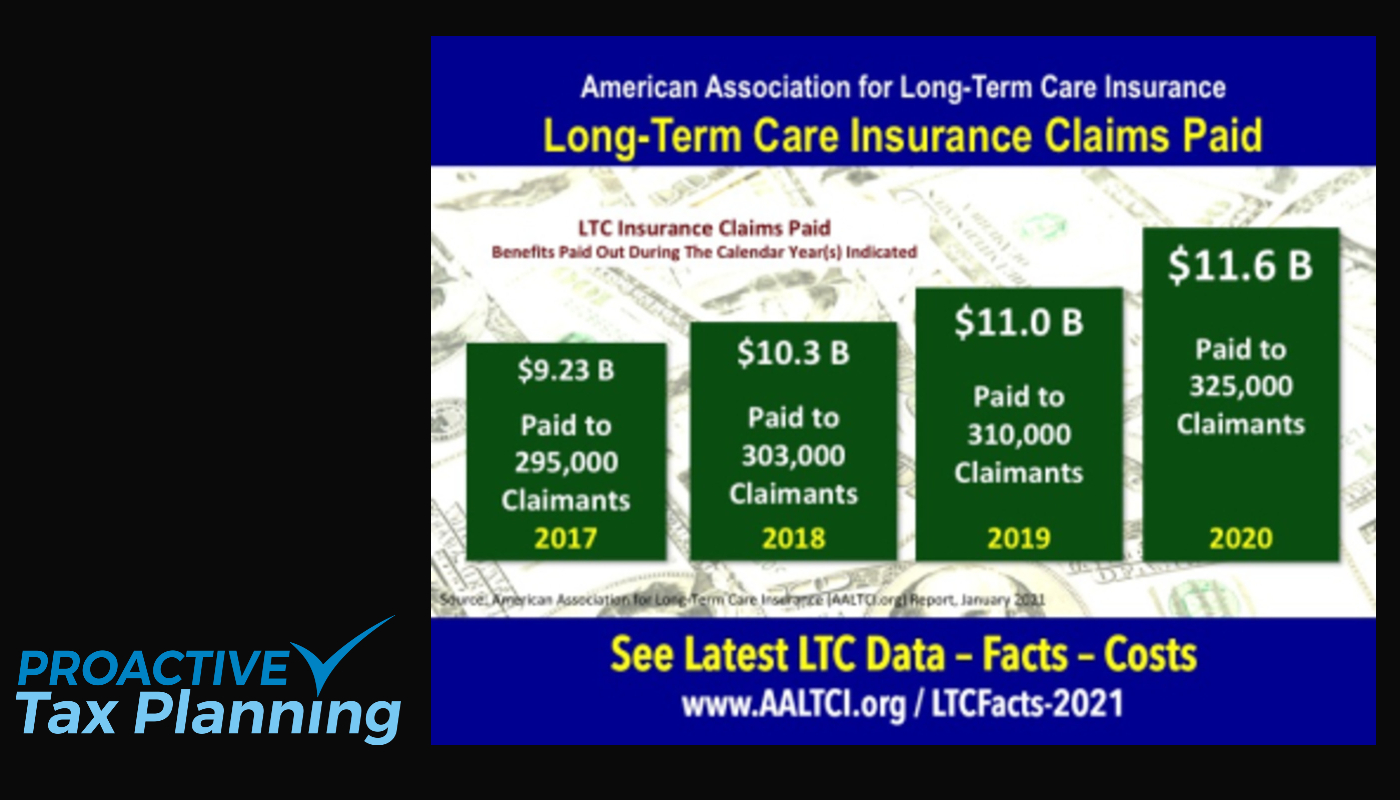

The nation’s long-term care (LTC) insurers paid out $11.6 BILLION in 2020, a $600 Million increase over 2019 according to the American Association for Long-Term Care Insurance (AALTCI). That is a huge amount of TAX-FREE benefits and only includes “traditional LTC insurance policies.

Most people haven’t planned ahead for LTC costs. I get it. LTC insurance is expensive, premiums can and will likely rise over time and you may never use it. BUT if you own a business or are self-employed, your premiums are partially tax-deductible!

But the smartest thing I ever did was get my LTC policy at age 40. If I die not needing my policy, I probably won’t even realize it then – lol! This pretty much has removed one of the 5 BIGGEST retirement risks off the table.

I just paid my premium this morning. And I paid Norma’s annual LTC premium too. I don’t love writing those checks, but I do love the knowledge that we have protected each other’s future lifestyle and finances should we ever need our policy’s LTC benefits. And we’ve protected our children from needing to take care of any of this too.

To boil it down… having some type of LTC protection is an act of love.

Anyway —

One way around this (use it or lose it) for couples is to buy a “SHARED” policy. Where if one spouse passes without using any or all of their benefits, the surviving spouse inherits those benefits. This makes it much more likely that your shared benefits are much higher than your total premiums paid over time.

There are also “combo” products that offer some LTC protection that is part of a life insurance or annuity policy. These combo products totally eliminate the “use it or lose it” objection since a benefit will be paid to SOMEONE!

That benefit will either be some LTC benefits if an LTC claim is made… OR a death benefit in the case of a life policy or the account value in the case of an annuity should the owner never need LTC benefits.

In general, a traditional LTC policy will provide more LTC benefits should the need arise, since there are no other benefits to the policy than a combo product. And a combo product will always deliver some benefit at some point but won’t be as robust as the traditional LTC product that has a singular purpose.

If you want to explore removing a huge risk to enjoying a successful retirement, just reach out to me.

all the best… Mark