Quick Summary:

My WHY: To help people proactively maximize every one of their financial resources and opportunities so they can enjoy a much fuller life and make a positive impact on our world.

My HOW: As a fiduciary, I use a holistic, comprehensive planning approach that employs multiple strategies to help my clients become more financially confident and secure today while preparing for a more predictable, secure, and extraordinary retirement. Whatever that word means to them!

My WHATS:

…..#1) I combine seven synergistic tax strategies to help my clients get their future cash flow off the IRS’s radar screen and legally pay as little as ZERO income taxes during retirement.

#2) I use multiple other financial strategies to remove as many other risks (market, inflation, LTC, etc.) from my clients’ retirement as possible.

My 2 Main Mantras:

1) Don’t Take Any More RISK Than You Need To Reach Your Goals

2) Don’t Pay Any More TAXES Than The IRS Legally Requires You

My whole financial planning practice boils down to two simple words: PROACTIVE Planning. It’s a process… not a product(s).

SOME QUICK INFO:

Since July 2000, Mark J. Orr, CFP® RICP® CLTC® has been a Certified Financial Planner™. He is also a Retirement Income Certified Professional®, Certified in Long-Term Care, and a fee-based Investment Advisor Representative who firmly believes that people should be PROACTIVE and not take an ounce more risk than they need to to reach their retirement income goals… nor should they pay a dime more in taxes than the I.R.S. dictates.

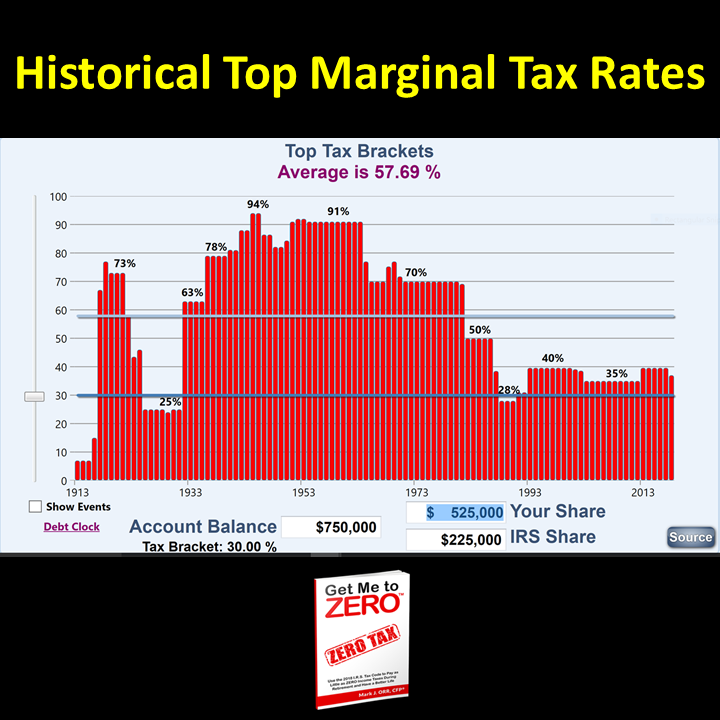

In fact, if someone thinks that taxes will go higher over the next 5, 10, or 20 years, he believes they should strive to get to the ZERO percent tax bracket in retirement. With planning, many can get there. See the chart below as to why

he thinks taxes will never be lower again.

His work starts with teaching folks about the 3 buckets of risk and the 3 tax buckets. As to reducing risk, he uses both actuarial science and portfolio management that will go to cash when markets get rocky to protect his client’s savings. As to striving to pay ZERO income taxes in retirement, he takes advantage of every IRS regulation PROACTIVELY to pay as little future taxes as the law requires.

The BOTTOM LINE:

He puts all of those philosophies, financial strategies, and tools together to design a fully personalized PROACTIVE “retirement income road map.” It’s a year-by-year income plan that combines pensions, Social Security filing strategies, and a mix of insurance and investment strategies to maximize lifetime after-tax net income and reduce investment risk to the lowest amount needed.

By the way, here’s my family at my daughter’s wedding. Norma and I are on the far left, then my nephew, followed by my son Mike, my former wife, Marina’s and Shane’s children from previous marriages, my daughter Megan and her boyfriend, my sister-in-law, my father, and my brother.

CLICK the photo for a clearer image, and then hit the back button to return to the page.

What an awesome day that was. It’s so much fun to have all three of my children and my four grandchildren living so close by!

More Details About Mark: Information Overload — (LOL)

Thanks to his seven books available for sale on Amazon.com, many clients from all over the country and from different walks of life have chosen him to help them with their retirement, legacy, and financial planning.

Along with his expertise in Social Security benefit planning, they chose Mark to grow, protect, and eventually help them with their investment planning to distribute their accumulated assets for a lifetime of retirement income.

Since 2000, Mark’s specialty has been giving retirement income planning advice for pre-retirees and retired people who want a safer, more reliable, and predictable income. But the first question they almost always ask him is, “What makes you different than our local financial advisor?” or “Why should we trust our financial future to someone we’ve never met before”?

Great questions. The answer is fourfold. First of all, he works only for his clients… and not for any financial institution. Besides being completely independent and fully objective, he takes a holistic approach to financial planning.

He’ll teach you about the six buckets of money. Once you fully understand those 3 risk and 3 tax buckets, you decide where you want your current and future savings to go. Given your own choices of buckets, he makes prudent investment recommendations to safely and predictably as possible help you reach your retirement income goals. We take the least risk possible while minimizing your total taxes as low as the IRS rules allow.

The next factor that makes him different is that most financial advisors fall squarely into one of two camps. Their career came from either a stockbroker’s… or an insurance agent’s mentality.

Most stockbrokers think the answer to every financial problem is stocks, bonds, mutual funds, hedge funds, private placements, variable products, etc., and they never consider fixed insurance-based solutions.

On the other hand, many insurance agents are not even securities licensed, so they can ONLY recommend insurance products. But even the ones that CAN recommend securities, most feel much more comfortable in the insurance world. So, neither of those conflicting approaches has the “right” answer or offers the only prudent solution to 100% of all financial goals. But you already know that!

His financial career grew simultaneously in both mindsets. Which approach may be best for a specific client’s situation and goals?

All financial products are just tools – like golf clubs. Each “club” has a specific purpose, like a putter, a sand wedge, a short iron, or a driver.

He provides his clients with the right combination of the top financial “clubs” to help them reach their specific financial goals. It’s not the “financial club” that’s most important; it’s the “swing” or our strategies. And isn’t having a solid retirement income “plan” what you want?

One more factor his clients will tell you that sets him even further apart as the advisor they prefer to work with. And the 4th leading reason why his clients chose him… is that, in addition to all I’ve just mentioned, he is a Certified Financial Planner and Retirement Income Certified Professional®.

A CFP® is the recognized industry certification of financial competence and ethics. CFP®s have an ironclad fiduciary responsibility to always put their client’s interests above their own and be fully transparent in their recommendations.

A RICP® has spent a year training for “income distribution,” – which is a very different skill set than the one most advisors concentrate on, which is saving for retirement.

Mark’s clients can count on complete confidentiality and that their welfare, interests, and goals always come first. Although that should go without saying, most financial advisors are NOT legally held to ANY fiduciary standard of care.

Most financial advisors will tell you that they can make you higher returns if you move your money so they can manage it. Maybe they can, but probably not without adding a lot more risk.

But he believes there is much MORE opportunity for you to significantly improve your future retirement by avoiding losses to your principal… than picking the “winners.”

He says: “Build it, grow it, and protect it.”

Few other advisors teach and base their retirement planning strategies on the six buckets of money. He ensures his clients fully understand exactly what he’s proposing and why since it fits within the six money buckets they choose.

And there are even other financial advisors who feel very comfortable and are competent in recommending and using financial products from BOTH a stockbroker’s and insurance advisor’s approach. But only a tiny percentage of financial professionals can do all of that plus qualify as a long-time, experienced Certified Financial Planner and fiduciary.

But this isn’t about Mark… it’s about YOUR retirement income. It’s about safely and efficiently reaching your financial goals with the least amount of stress, risk, and taxes along the way as possible.

Finally, with that in mind, let me ask you a simple but very important question: Are you 100% sure that you will have a great retirement… or do you have some doubts? Whatever your answer is, Mark hopes to hear from you soon.

The data from 1913 – 2008 is based on rates obtained from the IRS SOI Tax Stats: Individual Income Tax: Personal Expemptions and Lowest and Highest Bracket Tax Rates, and Tax Base for Regular Tax – – Historical Tables 23. (http://www.irs.gov/taxstats/article/0,,id=175910,00.html). After 2008, the information is taken from the Tax Rate Schedules published each year by the IRS.

Investment Advisory Services are offered through Retirement Wealth Advisors, Inc. (RWA), a Registered Investment Advisor. Mark J. Orr and RWA are not affiliated. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

This information is designed to provide general information on the subjects covered; it is not, however, intended to provide specific legal or tax advice and cannot be used to avoid tax penalties or to promote, market, or recommend any tax plan or arrangement. Please note that Mark J. Orr and its affiliates do not give legal or tax advice. You are encouraged to consult your tax advisor or attorney.

Life insurance and annuity guarantees rely on the financial strength and claims-paying ability of the issuing insurer. Any comments regarding safe and secure investments and guaranteed income streams refer only to fixed insurance products. They do not refer in any way to securities or investment advisory products. Fixed Insurance and Annuity product guarantees are subject to the claims‐paying ability of the issuing company and are not offered by Retirement Wealth Advisors, Inc. All life insurance and annuity products are sold separately through Mark J. Orr, CFP, RICP. PROACTIVE Tax Planning services are also offered separately through PROACTIVE Tax Planning, LLC.

Registered Investment Advisors and Investment Advisor Representatives act as fiduciaries for all of our investment management clients. We have an obligation to act in the best interests of our clients and to make full disclosure of any conflicts of interests, if any exist. Please refer to our firm brochure, the ADV 2A item 4, for additional information. Smart Financial Planning is not affiliated with or endorsed by the Social Security Administration or any other government agency.