In 1994, financial planner, William Bengen developed the 4% rule. It quickly became the guiding “formula” used by both professional advisors and do-it-yourselfers for about two decades.

The 4% rule (or theory) says that at retirement, with a portfolio of 60% stocks and 40% bonds, one could withdraw 4% of the initial savings and increase it by inflation every year and the retiree would have a 90% or better chance of his income continuing for 30 years and that the savings would not be completely depleted for until the end of those 30 years. By the way, a 100% stock or a 100% bond portfolio has less than a 60% chance of lasting 30 years.

So for example, someone with a $1 million at retirement could withdraw $40,000 the first year. If inflation was 3% that year, the second year they could withdraw $41,200. That growing income could conceivably last for 30 years until the savings and income would be all gone.

If you got on a plane and the pilot announced the good news that there is only a 90% chance of landing safely at your destination, would you get off that plane?

Given the two extreme bear markets in the 2000’s and the coming end to the 30 year long bull market in bonds (assuming you believe that interest rates will eventually rise to more normal levels as investors will demand higher returns from riskier borrowers as government, corporate and all other types of debt continues to skyrocket) — Mr. Bengen has all but repudiated that theory.

In fact, it wasn’t too long ago when he told a financial magazine that he would not use the 4% rule for his own retirement now.

The reason this theory is not used (except by “planners” who have not been keeping up with academic advances in financial planning) is largely due to something called “sequence of return” risk. In my upcoming book on retirement income planning, which is about 25% complete, I’ll be writing a lot about this investment risk.

Basically, sequence of return risk is that stock losses early in your retirement can have a very profound effect on whether you outlive your money or not. But for now, I’ll leave it at that.

Morningstar has since (2013) come out with its 2.8% rule (replacing the much more aggressive 4%) saying that is the withdrawal rate a 60%/40% stock/bond portfolio could reasonable rely on for a 30 year retirement. That means that $1,000,000 retiree could withdraw $28,000 their first year in retirement and have that figure grow by inflation.

In an article in the Wall Street Journal in 2013 entitled “Say Goodbye to The 4% Rule”, they suggested a 2% initial withdrawal rate would safely bring someone through a 3o year retirement.

My question, is what if you (or your spouse) live longer than 30 years in retirement? By the way, the safe withdrawal figure for a 40 year retirement plan is now only 1.5% according to the latest academic research. Personally, I can’t wrap my head around this figure, but do agree the safe withdrawal rate for 40 years must be lower than one for a 30 year retirement.

Now many folks believe there is no way that they will live 30 years in retirement. But if a couple has made it to age 65, there is a 50% probability that at least one of them will live to age 92. And a 25% chance at least one of them will celebrate their age 95th birthday (and perhaps more). And for better educated or healthier people the odds are even better.

In any case, would you rather plan on a 20 year retirement and be out of luck if you (or your spouse) lives 25 years, or plan on a 35 year retirement income stream and only live 25 years?

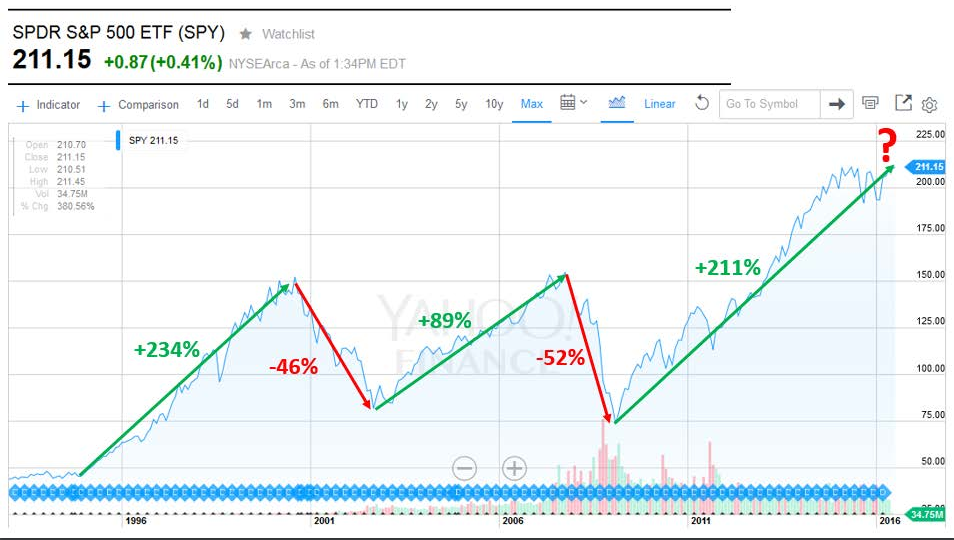

The chart below shows the S&P 500 index from 1992- through this week. As I write this BLOG today, the index is just 1% away from its all-time high.

My next question to you after looking at this chart is where do you think the index is more likely to head in the next few years – continue way up… or retrace some of its huge gains for a bit?

US corporate profit growth (which accountants can make whatever they want to) is slowing. Sales are not really growing either. The rise in stock prices over the last five years has had more to do with companies buying back their own stock (with borrowed money) and there being only extremely low interest paying investment alternatives… than the profit outlook of corporate America.

Anyway, for an investor retiring in the near future, the chart shows pretty clearly that the sequence of return risk — is probably not on their side. Some are taking a portion of their gains made over the last 6 years off the table and placing them in the “safe and secure” bucket that is not subject to market risk.

What’s the answer for somebody planning on retiring in the next one to five years? Well I fix this problem for my clients every week by designing a written retirement plan that shows year by year how we are going to fund their desired annual net spendable income.

It all starts with the 3 buckets of risk and taking as much sequence or returns risk off of the table as possible. Rather than just use “asset allocation” I add “income allocation” to the plan – so the plan has the best chance for predicable, reliable long-term success. I could go on and on… but that’s what my next book is going to focus on.

all the best… Mark