How much money does it take for a $54,000 annual retirement income for a married couple of 64-year-olds who want to retire in one year in retirement based on the 4% rule?

Well, that’s easy math. Simply divide $54,000 by .04 and you come up with $1,350,000.

As a reminder, the “4% Rule” says that you can take 4% of an investment amount and that would be your starting income which hopefully will last 30 years, growing by inflation each year. So, if one has a retirement account of $500,000, they conceivably take an income of $20,000 a year and grow that by inflation over 30 years.

Whether that “rule” will actually work is dependent on whether the sequence of returns your portfolio actually sees as favorable… or not. There are risks. One could run out of money in 22 years or could end up with more than double what they started with thirty years hence.

According to Morningstar, they currently suggest a 3.8% starting withdrawal rate increased by inflation) rather than 4% based on market conditions as of late 2022/early 2023. This is up from 3.4% a few years ago.

Anyway, let’s get back to that $1,350,000 figure and see if we can lower the investment needed for that $54,000 annual income using the 4% rule.

I took a fixed indexed annuity that didn’t even make it into my book, “I Didn’t Know Annuities Could Do That! and ran a test.

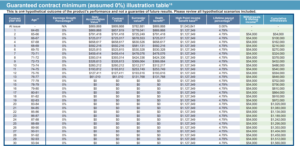

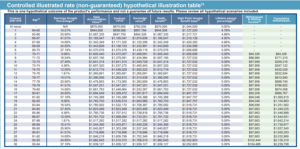

As you can see from the image below, in this particular fixed index annuity, it only costs just under $870,000 to GUARANTEE a 64-year-old couple a $54,000 annual income at retirement at age 65 – not only for 30 years – but for as long as either of them lived. And here’s the kicker. That level of investment assumes that the annuity earned ZERO interest every single year. It never has a gain at all. Not ever.

With this annuity, rather than $1,350,000, we just need $870,000 to accomplish the same thing. That’s $480,000 LESS money than the 4% rule.

Let’s look at this $870,000 from another perspective. Using the 4% rule, that amount would only imply a $34,800 starting income – NOT $54,000. That’s more than a $19,000 reduction than the guaranteed annuity.

At 3% inflation, it would take 15 years for the 4% rule to catch up to the annuity! Fifteen years! They’ll be 80 years old then. And that assumes the annuity never earns a dime and the guaranteed income never rises.

As you may know, fixed-indexed annuities can never suffer a market loss. Their worst return is zero.

So, although this couple would get a guaranteed JOINT LIFETIME income of $54,000, that income would never rise if the annuity never earned any interest, and it would also run out of cash value and a death benefit under those circumstances as shown right below. But the income will never stop as long as either of them is alive.

But nobody thinks any product will earn nothing for 30-plus years. Even so, during the 30-year period, they would have pulled out $1,566,000 GUARANTEED with no market risk whatsoever. Even more if one of them lived beyond 30 years.

CLICK on each image to see it crystal clear. Then hit your BACK button to return to the text.

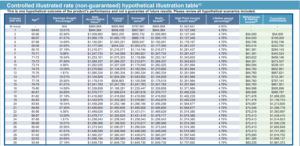

But let’s assume that the underlying indexes used in the annuity earn only 3.5% annually. How much income would the same $870,000 provide this couple? Let’s see.

The next image shows the same starting income of $54,000 but you can see it growing over the 30 years (2nd column from the right) to $83,000. That’s not much growth at all. But by using 3.5% average raw returns, we’d have some income growth.

Although this rise would not keep up with inflation, there’s no guarantee that the 4% rule will even last 30 years, let alone for longer than that.

The big difference with a 3.5% return instead of 0% can be found in the far-right column you can see $1,981,000 of lifetime withdrawals ($415,000 more).

But here’s the huge kicker, look at the $1,649,000 remaining death benefit at the end of the 30-year illustration. Put both figures together and you have $3,630,000 of total benefits over the 3 decades. Not too shabby with NO market risk using only 3.5% actual index returns.

Let me interject something important, before continuing. Annuities are not perfect. No investment is. Every place to store your savings has pros and cons. And such being the case, even insurance companies won’t let annuities represent more than 75% of your investments.

But annuities can do one thing that no other product can do… provide a guaranteed lifetime income. And fixed indexed annuities do that with reasonable upside and no stock market risk. And because of that, they are great bond and CD alternatives. And FYI, payouts for single folks are larger than joint payouts for couples.

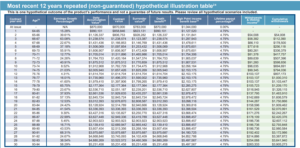

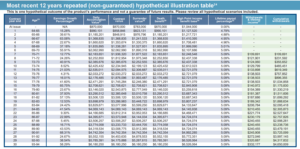

Just for fun, I thought I’d show you the illustration summary in this same scenario using the actual last 12 years’ returns of the annuities for the illustration.

Although I would NEVER, EVER use these income figures in anyone’s retirement income plan, it does show what’s possible. But in my planning, I’m always much more conservative. I generally use a 3% annual average increase, depending on the product.

If the next 12 years look like the last 12 years, you can see how this product would crush the 4% rule. The income shown rises at an average of 5.4% a year over the 30 years, going from $54,000 to $263,000 per year. Check out the potential 30-year income of over $3.9 million and a remaining death benefit of more than $5.2 million. But again, I would never use these numbers in a retirement income plan.

But clearly, the risk/reward is pretty compelling. A $54,000 minimum annual income for as long as either spouse lives with plenty of upside for a rising income and a substantial death benefit, even after 30 years of income.

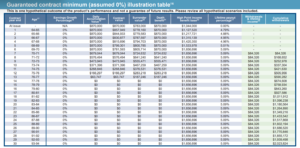

But what about delaying turning the income on? Of course, the longer this 64-year-old couple delayed turning on the guaranteed joint lifetime income, the larger the first check would be guaranteed to be.

Typically, when I do a retirement income plan, I delay turning on the guaranteed lifetime income for as long as the delaying makes sense. Let’s spend the “at-risk” assets first unless I’m using my BUFFER withdrawal strategy.

In the next image, by delaying turning on the income until age 70, the GUARANTEED joint lifetime income would be over $84,000 income (55% higher by delaying a bit longer) based on the same $870,000 initial purchase. That’s over $2 million cumulative income over the 30 years at ZERO interest earnings. NEVER earned a positive return. Just delaying the lifetime income by 6 years. This scenario is shown below.

You can see they eventually run out of cash value and death benefit… BUT they never run out of income. That’s what annuities do—provide guaranteed lifetime income.

But again, let’s look at the $870,000 from another perspective. Let’s say they invested that in a 60/40 portfolio and it earned 10% a year. Not likely, but it could do better or worse. In that case, over 6 years of delaying income, the investment would grow to $1,542,000. You’d certainly be taking much more risk.

Using the 4% rule, that would imply an initial income at age 70 of $61,680 per year. That’s $22,320 less than the guaranteed initial income of the annuity. At a 3% inflation rate, it would take 11 years to catch up with the annuity’s guaranteed income – assuming the annuity never earned a positive return. They would be 81 at that point.

But what if we change one variable? Instead of ZERO interest for 30 years, what if the underlying indexes earn just 3.5% every year? The same $870,000 and the same turning on the lifetime income at age 70. What would that look like?

At only 3.5% returns, you can see they would start off with an income of $84,000 which would slowly rise over time to $104,000 ($2.2 million cumulative income) and still leave a death benefit of over $1.9 million thirty years hence. That 3.5% return made a big difference.

And like before, JUST FOR FUN, let’s look at the delayed income illustration using the last 12 years of actual index returns. You know where to look for.

If the next 12 years look like the last 12 years, you can see how this product would crush the 4% rule. The income shown rises at an average of 3.7% a year over the 30 years, going from a starting income of $109,000 to $332,000 per year. Those figures would crush the 4% rule which would require a $2,725,000 portfolio to have the same initial income growing an average of 3.7%. That’s more than 3 times the level of investment put into the annuity.

And check out the potential 30-year income of over $4.6 million and a remaining death benefit of nearly $6.2 million. But again, I would never use these numbers in a retirement income plan. But we have a very compelling risk/reward situation with no market risk.

To clarify, I would not use just one annuity for an $870,000 bond alternative. I’d likely diversify by using 3-4 annuities with different indexes, strategies, and other attractive benefits.

But I hope that you get my point. It takes less investment to guarantee a lifetime income than the “buy, hold, hope, and pray”4% rule. No stress or worries about recessions and bear markets.

all the best… Mark