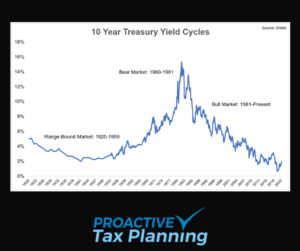

There has basically only been 3 long-term bond market cycles over the past century or so for U.S. 10-year Treasury bonds.

The 1st from 1920-1959 was rangebound interest rates from around 2% to 4%. That was due to a combination of deflation following the Great Depression and a cap on rates to help fund World War II in the 1940s.

Inflation picked up in the 1960s and rates followed its lead. Prices spiked even higher in the 1970s and inflation didn’t ease until the Fed raised rates to more than 20% by the early-1980s. That bond bear market lasted more than two decades.

The disinflationary period that followed is likely the most impressive bond bull market ever and won’t likely ever be duplicated. There have been a number of spikes along the way but the trend in interest rates has been down for 40+ years.

Rates are now rising again with the 10-year going from a low of 0.5% in the summer of 2020 to about 2.5% a week ago. And the FED is expected to raise the Fed Funds rate 4-7 more times in the next 12 months. More pain for bondholders.

Is this the end? Is the four-decade bond bull market over? Should investors prepare for a bear market in bonds? How about those 60%/40% retiree portfolios should rates continue to move upward?

If so, what can bond investors do about rising rates… causing falling bond prices?

As of last Friday, the Barclays Bond Index has lost -6.89% so far in 2022 and only yields 3% — less than half of inflation. the US Corporate Bond index has lost -8.71% and only yields 3.67%.

My book, “BUFFER Annuities” explains a much better bond alternative that offers principal protection and likely average returns of 4%-6% over time with no fees as the basis of a smart withdrawal strategy.

You can get your copy at Amazon here: https://www.amazon.com/dp/B09CGBNLL

Another alternative our firm uses, are our FLASH NOTES. Over the last 18 months or so, these 1-Year notes have paid coupons of 6% – 14% (our clients buy about $40-50 million of these notes each month). They have a higher interest rate than high-yield bonds and are less risky. And they are issued by major banks such as JPMorgan, Chase, Bank of America, Credit Suisse, etc.

You can’t just sit and watch your bond values drop (while collecting very low interest payments to boot). Let’s talk!

all the best… Mark