I am certainly not trying to scare anyone here, but only add some sanity to the conversation.

Over and over again, in my discussion with folks interested in my financial services and planning as well as some long-time clients, they clearly have forgotten 2000, 2001, 2002, and 2008. And the lightning-quick market rebound in March 2020 from the COVID virus, many don’t seem to believe that markets won’t go down – at least not for a year or longer.

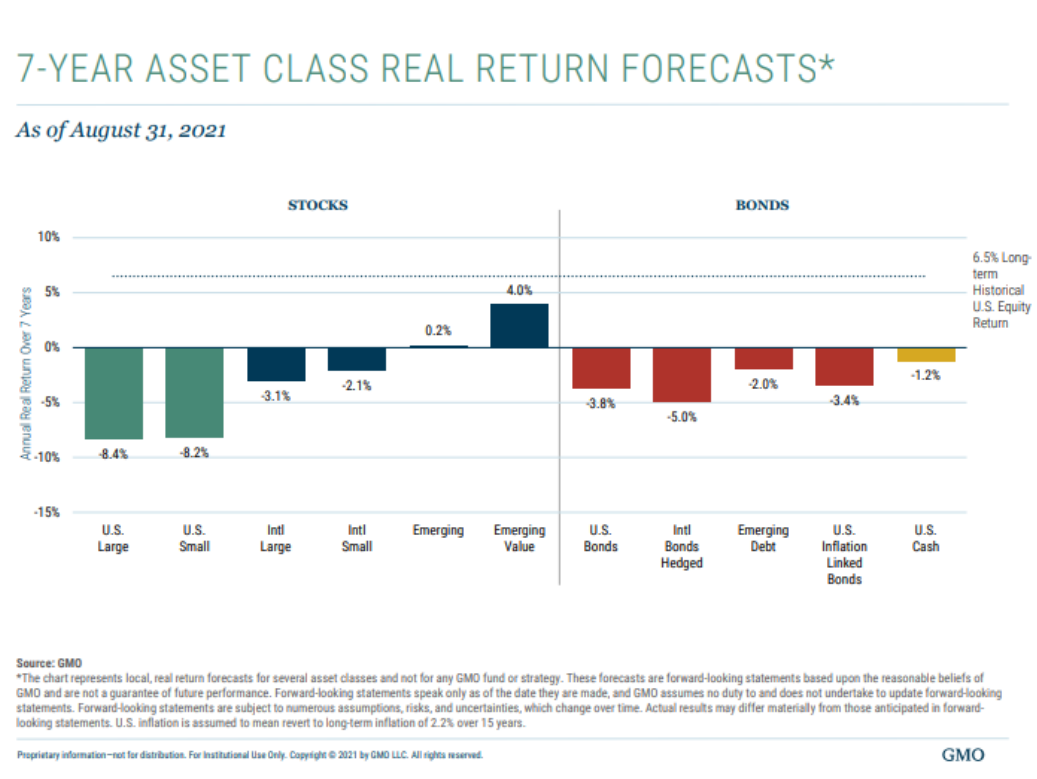

So here’s another well-respected money manager’s (GMO) dismal view of the market. Like mutual fund giant Vanguard’s forecast that I’ve posted here before, GMO’s forecasting model is predicting annual negative returns over the next few years.

It’s predicting average returns over the next 7 years of -8.4% for U.S. large-cap stocks and -3.8% for U.S. bonds.

These returns are so awful, over the entire 7 year period that would leave investors with total returns of -46% for stocks and -24% for bonds.

Hence, for a 60/40 portfolio, that’s a return of -37% in total. A $10,000 investment under this scenario would leave investors with around $6,300 in their portfolio after 7 years.

Do you agree with GMO and Vanguard that the next 7-10 years are going to be a bit rough at the very least?

Do you have a plan to deal with any prolonged market downturn, let alone a potential 30%, 40%, or larger stock market drop?

Hedging strategies and a disciplined plan to go to cash for equities and using bond alternatives for the fixed income portion of your portfolio are going to be a must.

Neither I, my firm nor anyone has all of the answers, but I can recommend quite a few strategies to prepare for the inevitable drop (as the market always does) and eventual recovery.

My new BUFFER ANNUITIES book offers just one.

all the best… Mark