Of course, nobody knows what the future holds in the stock and bond markets. Warren Buffett has said for years that in the next decade the stock market will only return mid-single digits (including dividends). Maybe he’s too bullish (at least according to Vanguard).

In this Blog Post, I’m featuring market predictions from Vanguard for the next 10 years – just published in their April 2021 Advisor newsletter.

I’m sure many of you will be surprised to see their predictions!

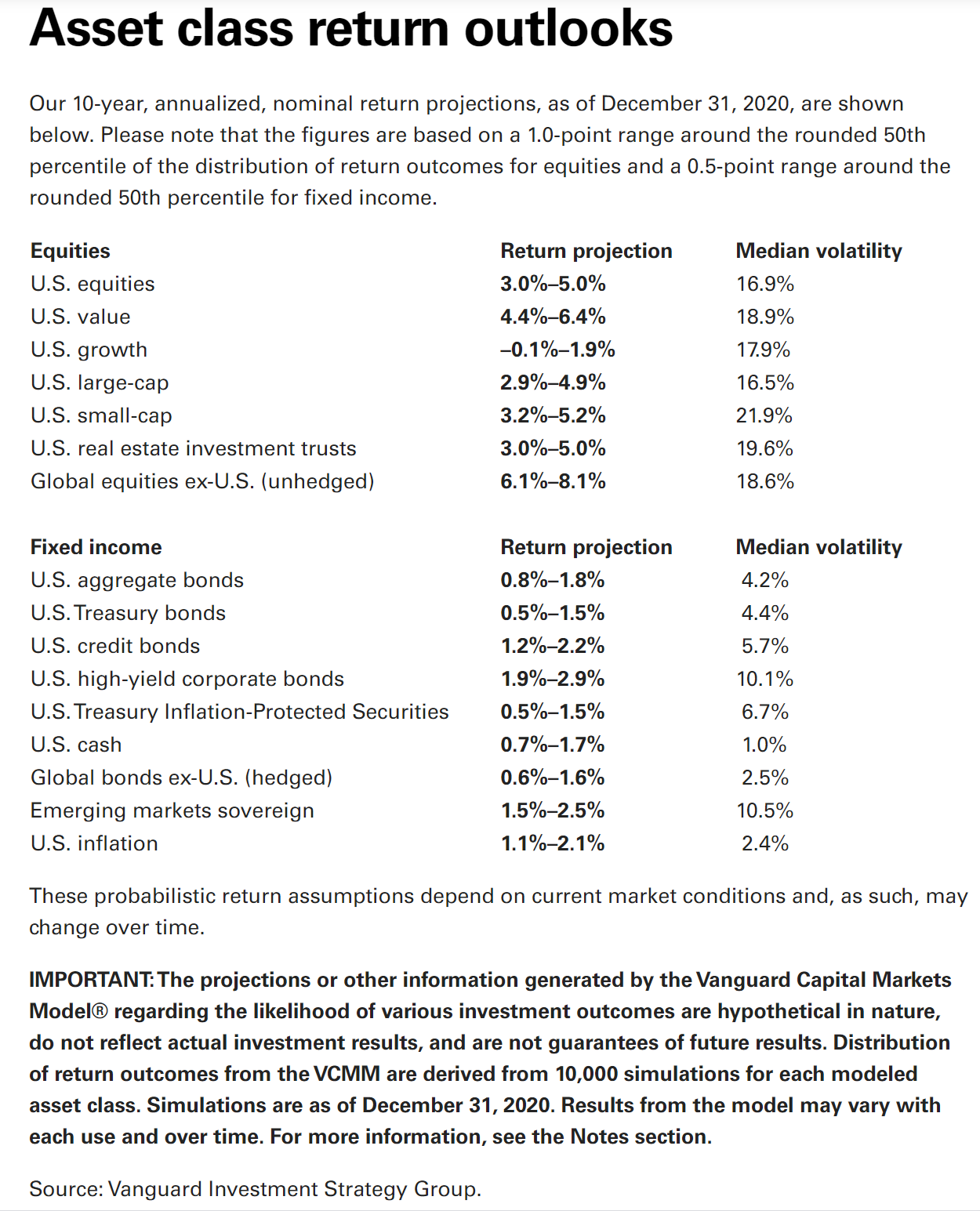

Look what they are projecting for US large-cap stocks as far as average annual returns for the next decade (better for large value than large growth). Vanguard’s projected growth for the next decade is about 1/3 that of the last 10 years!

The Medium Volatility indicates the range of potential returns on either side of the projected returns. So US large-cap could deviate 16.9% up or down from the range of 3-5% returns (-13.9% to +21.9%) in any single year.

And LOOK at the projections for bonds!! Can your retirement portfolio survive and thrive with .8% to 2.9% bond returns?

Just another reason why all investors need to learn about bond alternatives. Contact me to learn how you can balance the risk in a stock portfolio with bond alternatives that should earn 3%-7% or more without market risk! No interest rate or credit risk either. And past gains can never be lost.

all the best… Mark