I just finished updating my “I Didn’t Know Annuities Could Do That!” book, and I thought I would pass along a chapter. One that is causing some well-founded excitement for risk-averse folks and people searching for bond alternatives with falling interest rates expected in 2025 and 2026.

What if there was a place to store either IRA or non-IRA money that had NO fees or expenses, took NO market risk, and could get a return of 75% of the S&P Futures index (excluding dividends) in a year and 100% of the gains in the 2-year index?

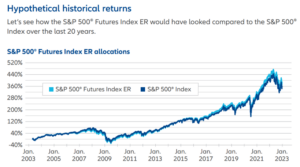

The S&P 3-month Futures index has closely tracked the S&P 500 index for over a decade and, in recent years, has done slightly better (see the 2nd chart below).

A NOTE from my Compliance Dept: Talking about fees. As I explain in my book, commissions are paid by the insurance company on annuities, but rather than taking a big 4%-5.5% upfront commission like many agents do, I prefer to take a 1% annual fee based on the growing account balance.

Neither commission option affects the client’s account one bit. But that way, my clients and I both sit on the same side of the table – a growing account over the long term makes us both happy.

Here goes from the updated chapter:

Ok, let’s move on to my favorite accumulation-only, Fixed Index Annuity (FIA). It has no fees deducted from your account balance and offers a very attractive index in both 1-yr. and 2-year options, which you’ll learn more about in a moment. Norma (my wife) recently bought two of them (one from a partial 401K rollover and the other from her savings account), and I bought one, too.

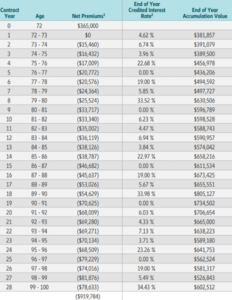

The next chart shows this no-fee accumulation FIA with a 7-year surrender charge period and a $365,000 deposit, with the client taking only RMDs.

Column 2 shows both the one-time single premium ($365,000) and only the annual Required Minimum Distributions (RMDs) being paid out (numbers in parentheses). They didn’t need the income but the IRS mandates RMDs.

Column 3 shows the rates of returns credited to his IRA (based on the last ten calendar years), and column 4 shows the growing accumulation values over time – even after taking annual RMDs. Taking only RMDs, look at how both the RMDs (2nd column) and account balance (4th column) grow for his heirs.

In this illustration, the client wanted to use 50% of the IRA funds in the one-year S&P Futures index and the other 50% in the two-year indexes. After two years, the 2-year S&P Futures index gets 100% of whatever that index earned (excluding dividends).

If the next thirty years look like the last ten years, he’ll have taken over $900,000 out of this IRA through RMDs (if he lives to age 100), and there is still some $602,000 of death benefit (accumulation value) for his spouse or heirs.

Of course, if he passes away before then, any accumulation value at that time would go to the heirs in a lump sum. Since this is an IRA, a spouse can essentially make it her own and take RMDs based on her life. If the beneficiary(s) is not a spouse, then the account must be emptied out within ten years but can continue to grow tax-deferred until then.

Now, here’s the index that powers it all.

The next chart shows how the 3-Month S&P 500 Futures index closely tracks the actual S&P 500 (excluding dividends). It even did slightly better than the well-known index over the last few years, as you can see. This 3-month Futures index was launched on August 11, 2010, so it’s over 14 years old. The earlier years on the chart are backtested based on the same mechanics and methodology applied to the index. But I ignore them.

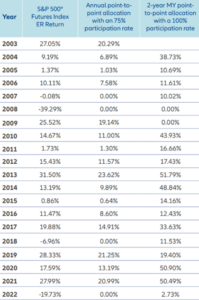

The next chart shows past annual returns for the 1-yr and 2-yr index allocations. There are participation rates for this index are (currently 75% in the 1-year term (column #3) and 100% in the 2-year term in the 4th column for single premiums over $100,000. Participation rates for lesser amounts ($20,000 is the bare minimum) are substantially lower.

As you can see, the calendar year returns are very impressive, especially considering there are no fees being deducted from the account, and ZERO is your hero (no market losses ever). Again, I’d really only look at 2011 and after, as the index did not exist in earlier years.

As shown above, in 2022, the S&P 500 lost 19.44%, excluding dividends. Not shown above are the calendar years 2023 and 2024. Just for fun, let’s see what our returns would have been for those years.

In 2023, the S&P 500 index returned 24.23%, and in 2024, the index earned 23.31% (excluding dividends, which FIAs don’t include).

This index inside the FIA would have had zero return in 2022, but that’s better than a double-digit loss!

In the 1-year bucket, this index would have earned roughly 18% (2023) and 17% (2024), respectively (at 75% participation).

The 2-year index (2022-2023) would have earned about 24% over the two years – averaging 12% per year.

However, the return for the 2-year bucket with 100% participation ending in (2023-2024) would be 47.52% (averaging about 23.76% per year).

That’s pretty impressive, given the fact that there is no market risk and no fees or expenses. Not even backtesting. Using actual returns for those three calendar years.

My preferred strategy is to initially allocate 50% to this index in the 1-year term and 50% in the 2-year term. After the first policy year, the 1-yr allocation moves to a brand new 2-year period. Think of it as laddering, so from then on, we get a 2-year index maturing every single year with a 100% participation rate. I use that strategy for both Norma’s annuities, my own, and my clients. Unfortunately, the software can’t show changing allocations like laddering.

I don’t typically use any of the other attractive indexes, including the typical S&P 500 index, which has an impressive 10% annual point-to-point cap! That’s a great option for when you don’t think the S&P is going to do 14% or more in a year (14% gain times 75% par = 10.5%).

Keep in mind, that I consider FIAs as bond alternatives – NOT alternatives for equities. Don’t forget that bonds can lose money when interest rates jump. The diversified bond index lost some 13% in 2022.

For after-tax money like brokerage accounts, CDs, and such, not having to pay 1099s to pay annual taxes is a very nice benefit for all non-qualified FIAs.

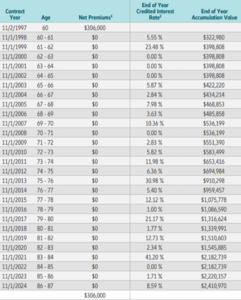

The next image is taken from this same accumulation FIA with a $306,000 purchase of non-IRA money (no RMDs) taken from money markets that were earning 5%, but those rates have headed lower recently.

These backcasted returns are from November 2, 1997, to November 1, 2024. Why these dates? Because I ran the illustration in January and these ending December figures weren’t in the system yet. And all of these interest credits are tax-deferred.

This list of returns from this accumulation FIA uses my favorite index, with 1- and 2-year periods. Again, I used half the premium in the 1-year bucket that earns 75% of the S&P 500 Futures index returns and the other half of the premium in the two-year option, which has a 100% participation rate of the index returns after two years. Keep in mind that there is NO Cap or upside limit to what the index can gain in either the 1- or 2-year terms.

Notice in the chart above the three years of ZERO returns (2000, 2001, and 2002). During that time, the actual index lost 50%. But not in an FIA. Zero is your hero. Also, look at 2013, 2017, and 2021 with over actual 20% returns. Bonds or CDs won’t do that. That illustration does not show any withdrawals, as the client will likely not need the money for over 20 years.

So, all this growth to $2.4 million (which worked out to about 8.3% per year over those 26 years) is tax-deferred with no fees or expenses and, of course, no market risk.

There won’t be any tax until the client withdraws money. There are no annual 1099 forms going to the IRS. Who likes paying income taxes on money they aren’t spending? And if this was a ROTH IRA, there would never be taxes due – to the policy owner or their heirs.

Most of my clients would gladly exchange these returns, having no possibility of loss for getting most of the index gains against the risk of the stock market. Zero is your hero. Yet, it offers plenty of upside without stress or worry.

Not only that, but this particular FIA allows us to actually lock in and keep our earnings (without any tax consequences) at any time during the 1- or 2-year period. Then, on the next policy anniversary, we decide how we want to reallocate those funds. So, you can capture gains within a policy year (or 2-year) without any taxation (vs. non-qualified accounts). That’s impressive!

It’s the only insurer that I know of with the ability to do that (lock in gains), which is why I like this company so much. This is a very cool feature that my clients appreciate very much. The longer the index time period, the higher the potential growth.

To be sure, I never tell one of my clients to expect 7.5%- 8.5% average returns in ANY FIA. Because there will be 0% years when the index goes down, as you can see. You can count on some zeroes along the way. But again, not losing any money is a benefit in and of itself.

When putting one of these FIAs in a written retirement income plan, I typically use a very conservative 5%-6% average return since this, like all FIAs, is a bond and CD alternative. But you can see the potential to beat that expectation with no market risk or cost.

Steve Jobs (co-founder of Apple) repeated this statement often, “People do not know what they want… until you show it to them.” I showed Norma and some clients, who together have put millions of dollars to work into this unique FIA.

Contact me if this might be something that you would want to explore further.

all the best… Mark

P.S. – Here’s the link to Amazon if you would to read the full book (paperback or KINDLE). CLICK HERE

or copy and paste: https://www.amazon.com/dp/B0D12XKBG5